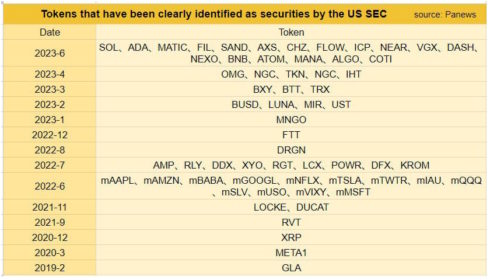

Our cherished digital assets may not be as innocent as you think!” This line could easily be mistaken for sensationalist tabloid fodder, but unfortunately for crypto enthusiasts around the globe, it has become a startling reality. In a move that has left the world of digital currencies in a state of shock and uncertainty, the US Securities and Exchange Commission (SEC) has officially classified more than 50 popular cryptocurrency tokens – including the likes of Cardano ($ADA), Terra ($LUNA), and Tron ($TRX) – as securities. Let’s take a look at these crypto tokens as securities in more detail.

Crypto Tokens as Securities: ADA, LUNA, and TRX – Now Official Securities!

In a landmark decision that has sent shockwaves rippling through the crypto sphere, the US SEC has boldly declared over 50 tokens, including industry heavyweights such as ADA, LUNA, and TRX, as securities. This audacious move by the SEC forms part of a larger initiative to bring order and regulation to the crypto marketplace, often compared to the Wild West for its volatility and lack of oversight.

Crypto Tokens as Securities: What Does This Mean for the Average Crypto Investor?

As a crypto investor, you’re likely asking yourself, “Why should I care?” The answer is simple: the repercussions of this decision are extensive and could fundamentally change how you interact with these digital assets. With these tokens now classified as securities, they fall under the SEC’s regulatory purview. This means they are now subject to rigorous regulations that could affect their liquidity, their practical use cases, and even their overall market value.

Settlements with the SEC: A Beacon of Hope in Uncharted Waters

But let’s not lose hope just yet. In a surprising twist, a number of the affected tokens have successfully negotiated settlements with the SEC. These settlements represent a beacon of hope amidst the turmoil, suggesting that a path forward exists, albeit a challenging one.

Read more: cryptoticker.io